Depreciation of Assets

Compared to the often uncertain estimates one has to do where appreciation of assets is concerned, we are on somewhat firmer ground here.

Governments tend to set up precise rules as to how you are required to calculate depreciation for tax purposes.

It is easy to look up in references such as "Blue Books" estimates of what an automobile should be worth after 3 years of use.

Since depreciation of assets is very often driven by tax policies, the discussion of depreciation will focus in that direction, on some of the more common depreciation calculation schemes.

While there has been some discussion about how to accomplish automated calculation and creation of transactions to handle things like depreciation, there is not yet any working code, so for now, you will have to do calculations by hand.

Depreciation schemes

Linear Depreciation

Linear depreciation diminishes the value of an asset by a fixed amount each period until the net value is zero. This is the simplest calculation, as you estimate a useful lifetime, and simply divide the cost equally across that lifetime.

Example: You have bought a computer for $1500 and wish to depreciate it over a period of 5 years. Each year the amount of depreciation is $300, leading to the following calculations:

Table 7. Example 1

| Year | Depreciation | Remaining Value |

|---|---|---|

| 1 | 300 | 1200 |

| 2 | 300 | 900 |

| 3 | 300 | 600 |

| 4 | 300 | 300 |

| 5 | 300 | 0 |

Geometric Depreciation

Each period the asset is depreciated by a fixed percentage of its value in the previous period. In this scheme the rest value of an asset decreases exponentially leaving a value at the end that is larger than zero ( i.e. - a resale value).

Beware: Tax authorities may require (or allow) a larger percentage in the first period. On the other hand, in Canada, this is reversed, as they permit only a half share of "Capital Cost Allowance" in the first year. The result of this approach is that asset value decreases more rapidly at the beginning than at the end which is probably more realistic for most assets than a linear scheme. This is certainly true for automobiles.

Example: We take the same example as above, with an annual depreciation of 30%.

Table 8. Example 2

| Year | Depreciation | Remaining Value |

|---|---|---|

| 1 | 450 | 1050 |

| 2 | 315 | 735 |

| 3 | 220.50 | 514.50 |

| 4 | 154.35 | 360.15 |

| 5 | 108.05 | 252.10 |

Sum of digits

A third method most often employed in Anglo/Saxon countries is the "sum of digits" method. Here is an illustration:

Example: First you divide the asset value by the sum of the years of use, e.g. for our example from above with an asset worth $1500 that is used over a period of five years you get 1500/(1+2+3+4+5)=100. Depreciation and asset value are then calculated as follows:

Table 9. Example 3

| Year | Depreciation | Remaining Value |

|---|---|---|

| 1 | 100*5=500 | 1000 |

| 2 | 100*4=400 | 600 |

| 3 | 100*3=300 | 300 |

| 4 | 100*2=200 | 100 |

| 5 | 100*1=100 | 0 |

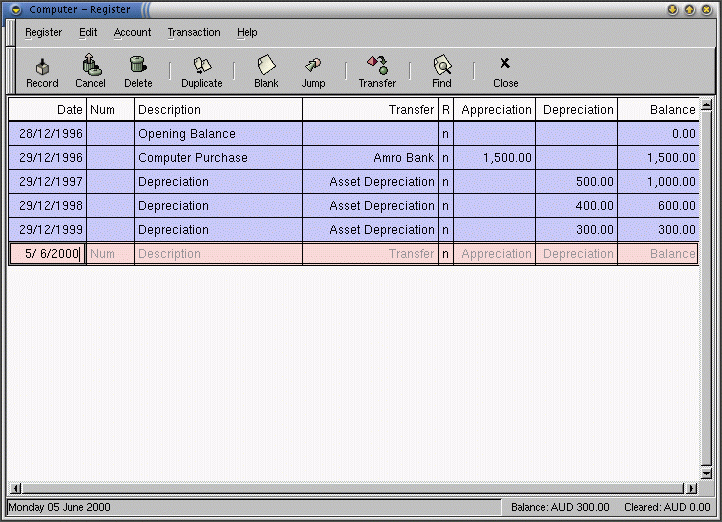

The Handling of Depreciation in GnuCash

In order to keep track of the depreciation of an asset, you need :

An Asset Cost asset account to keep track of the original value;

An Accumulated Depreciation asset account in which to collect the sum of all of the years' depreciation amounts;

A Depreciation Expense expense account in which to record periodic depreciation expenses.

The first step is to record the purchase of your

asset by transferring the money from bank bank account to the

asset cost account. Afterwards, in each accounting

period you record the depreciation as an expense in the

appropriate account.

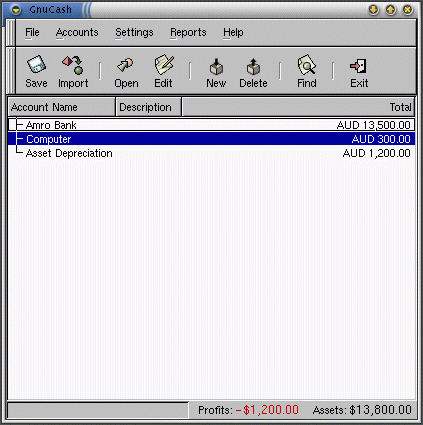

The two windows below show your asset account and the main

window after the third year of depreciation using a "sum of

digits" scheme for the example above.

A Word of Caution

Since depreciation and tax issues are closely related, you may not always be free in choosing your preferred method. Fixing wrong calculations will cost a whole lot more time and trouble than getting the calculations right the first time, so if you plan to depreciate assets, it is wise to make sure of the schemes you will be permitted or required to use.